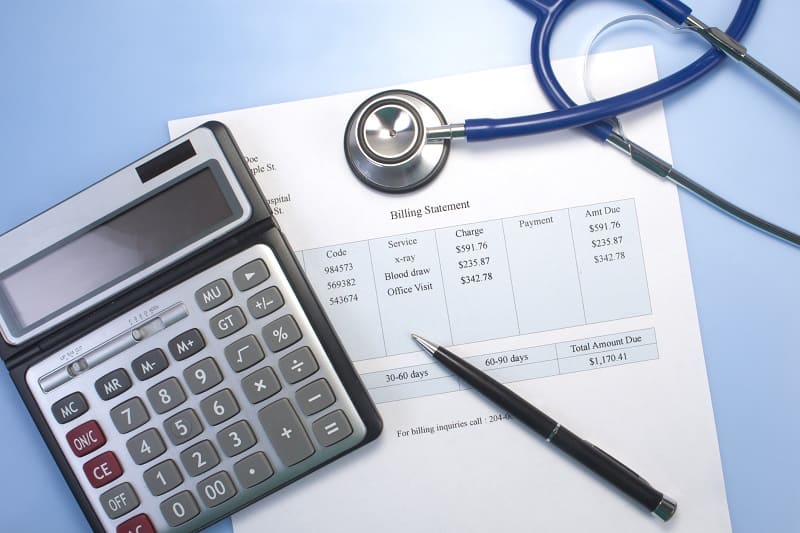

In today’s complex healthcare reimbursement landscape, medical billing and coding accuracy directly impacts a provider’s revenue cycle. Even small errors can lead to claim denials, delayed payments, compliance risks, and lost income. For healthcare organizations across the United States, minimizing billing and coding errors is no longer optional; it’s essential for financial sustainability.

This blog explores how medical billing and coding errors affect revenue and outlines practical strategies to prevent them, helping healthcare providers protect their bottom line while staying compliant.

Understanding Medical Billing & Coding Errors in Healthcare

Medical billing and coding errors occur when diagnosis codes, procedure codes, or billing details are incorrect, incomplete, or outdated. These mistakes can happen at multiple points in the revenue cycle, from clinical documentation to claim submission.

Common examples include:

- Incorrect or outdated ICD-10 codes

- Mismatched CPT and diagnosis codes

- Missing modifiers

- Duplicate billing

- Inaccurate patient or insurance information

In the U.S. healthcare system, where payers closely scrutinize claims, even minor inaccuracies can trigger denials or audits.

The Financial Impact of Billing & Coding Errors on Revenue

1. Increased Claim Denials and Rejections

One of the most immediate effects of coding errors is claim denial. Denied claims require rework, resubmission, and follow-up, which consumes valuable time and staff resources. In many cases, denied claims are never recovered, resulting in permanent revenue loss.

According to industry studies, healthcare providers can lose 3–5% of annual revenue due to unresolved denials linked to billing errors.

2. Delayed Reimbursements And Cash Flow Issues

Incorrect claims slow down the reimbursement process. Delays in payment can strain cash flow, making it difficult for healthcare organizations to manage payroll, invest in technology, or expand services.

For practices operating on thin margins, delayed reimbursements can significantly impact financial stability.

3. Compliance Risks And Regulatory Penalties

Coding errors aren’t just financial issues, they’re compliance risks. Incorrect coding can lead to:

- Overbilling or underbilling

- Medicare and Medicaid audits

- Fines and penalties

- Damage to provider reputation

With strict regulations and evolving payer guidelines, maintaining ICD-10 compliance is critical for avoiding legal and financial consequences.

4. Increased Administrative Burden

Billing errors increase the workload for internal teams. Staff members spend countless hours correcting claims, responding to payer inquiries, and tracking appeals.

Over time, this administrative burden can lead to burnout, inefficiency, and higher operational costs.

Root Causes of Medical Billing & Coding Errors

Understanding the causes is the first step toward prevention. Common contributors include:

- Inadequate clinical documentation

- Frequent changes in coding regulations

- Lack of ongoing staff training

- Manual billing processes

- High claim volumes with limited internal resources

Without the right systems and expertise in place, errors become inevitable.

Proven Strategies To Prevent Medical Billing & Coding Errors

1. Invest In Continuous Coding Education

Medical coding standards evolve regularly. Ongoing training ensures billing and coding staff stay current with:

- ICD-10 updates

- CPT code changes

- Payer-specific guidelines

Educated teams make fewer errors and submit cleaner claims.

2. Improve Clinical Documentation Accuracy

Clear, complete clinical documentation supports accurate coding. Encouraging providers to document thoroughly reduces ambiguity and coding discrepancies that lead to denials.

3. Implement Regular Billing Audits

Routine audits help identify recurring issues before they escalate. Internal or third-party audits can uncover:

- Coding inconsistencies

- Compliance gaps

- Revenue leakage

Proactive audits protect both revenue and compliance.

4. Leverage Advanced Billing Technology

Modern medical billing platforms and automation tools reduce human error by:

- Flagging incorrect codes

- Validating claims before submission

- Tracking denials and follow-ups

Technology enhances efficiency and accuracy across the revenue cycle.

5. Outsource To An Experienced Medical Billing Partner

Partnering with a trusted medical billing company allows healthcare organizations to focus on patient care while experts manage billing complexity.

Final Thoughts: Accuracy Is the Key to Revenue Protection

Medical billing and coding errors can silently erode revenue, disrupt cash flow, and expose healthcare organizations to compliance risks. Preventing these issues requires a strategic approach that combines training, technology, audits, and expert support.By partnering with an experienced provider like MEDSTAT, healthcare organizations gain a reliable ally dedicated to protecting revenue, improving accuracy, and ensuring long-term financial health in today’s demanding U.S. healthcare environment.